Why we chose it: We chose the as the best travel credit card due to its affiliation with the Chase Ultimate Rewards program, its exceptional travel perks, and its generous bonus categories for rewards.

#CHASE FREEDOM CARD 150 CASH BACK PROFESSIONAL#

Why we chose it: The offers the best rewards rate on entertainment purchases-including concerts, amusement parks, zoos, professional sporting events, and more. Rewards only redeemable for Costco merchandise or cash back in stores.

Great earning rate for dining, travel, and Costco spending.Exceptional rewards on gas and EV charging purchases.Rewards: Earn 4% cash back on up to $7,000 spent on eligible gas and EV charging purchases per year (then 1% back), 3% back on restaurants and eligible travel, 2% on purchases from Costco and, and 1% back on other spending.Īnnual fee: annual fee with Costco membership This means bonus rewards on gas are available at nearly any gas station-not just at Costco. Why we chose it: While the members only, this card offers 4% cash back on up to $7,000 spent on eligible gas and EV charging purchases per year (then 1% back). Annual fee after year one ( Rates & Fees).Charges in foreign transaction fees ( Rates & Fees).High Go-To APR ( ) after introductory APR period ends ( Rates & Fees).Rewards only redeemable for statement credits.Comes with purchase protection and return protection.Introductory 0% on purchases and balance transfers for 12 months ( Rates & Fees) then reg_apr,reg_apr_type.Welcome offer: Earn a $250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months. gas stations and on transit, and 1% back on other purchases. supermarkets each year (then 1% back), 6% back on select U.S. Rewards: Earn 6% cash back on up to $6,000 spent at U.S. The card also has an impressive welcome offer and intro APR on both purchases and balance transfers ( Rates & Fees). Why we chose it: We picked the Blue Cash Preferred® Card from American Express as best for groceries due to its sky-high rewards rate in this category. High APR ( ) after intro offer ends for balance transfers.

for balance transfers then reg_apr,reg_apr_type.Lucrative flat-rate rewards on all purchases.Why we chose it: The lets cardholders earn 2% cash back on everything-1% when a purchase is made and another 1% when it's paid of -and there is a annual fee. Bonus rewards caps in quarterly categories.

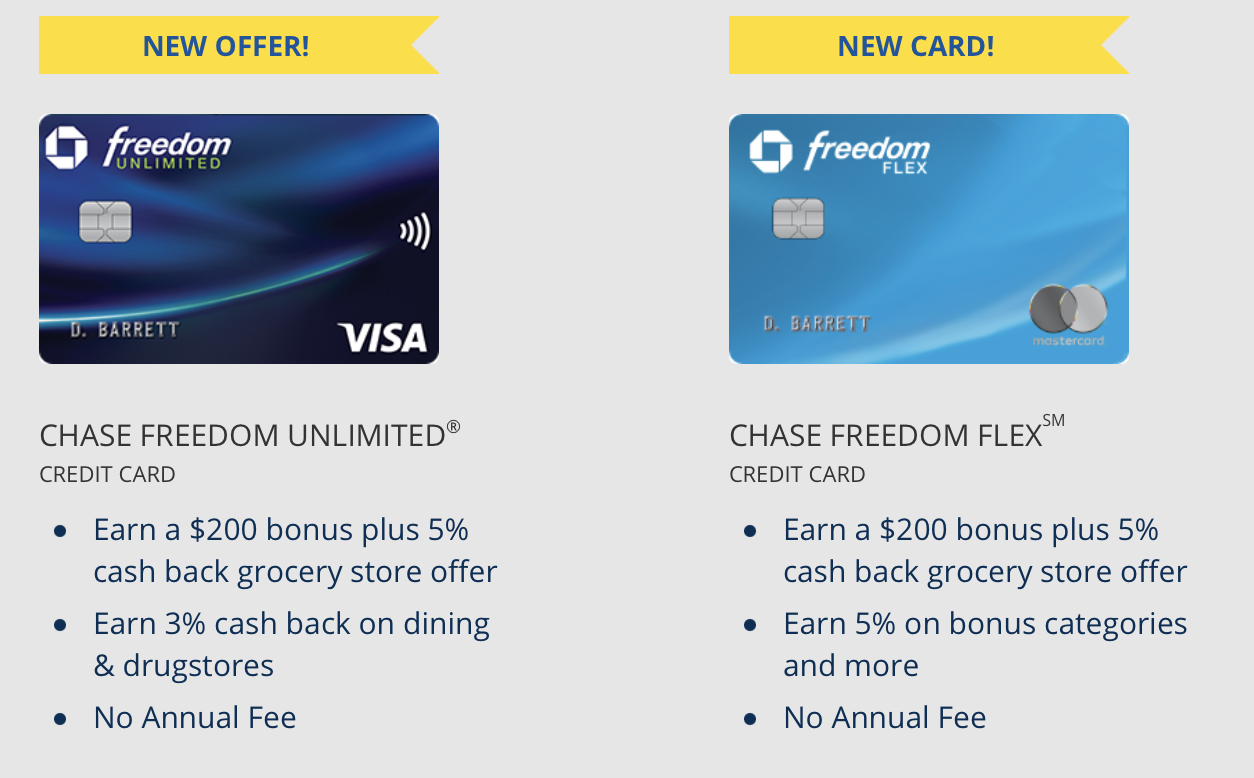

Comes with purchase protection, extended warranties, and other perks.Why we chose it: The card_name was selected as the best cash-back credit card due to its quarterly bonus categories that earn 5% cash back, its generous rewards for drugstore and dining purchases, and its intro 0% APR offer for purchases and balance transfers.

0 kommentar(er)

0 kommentar(er)